Get Your Taxes Prepared for Free!

Filing your taxes can be complex and confusing. Queens Public Library has compiled a resource of partner organizations who will be providing virtual tax help this year.

Get the complete list of organizations you can work with here.

Contact them directly for more information on the services they provide. Please note that Queens Public Library does not operate these programs, does not vouch for the accuracy of information disseminated during such programs, and assumes no responsibility for any statements made.

The following standard documents are required to prepare your taxes:

• Photo ID – driver license, state-issued non-driver ID, NYC ID or passport (for you and your spouse, if filing jointly)

• Social Security card for you, your spouse, and your dependents

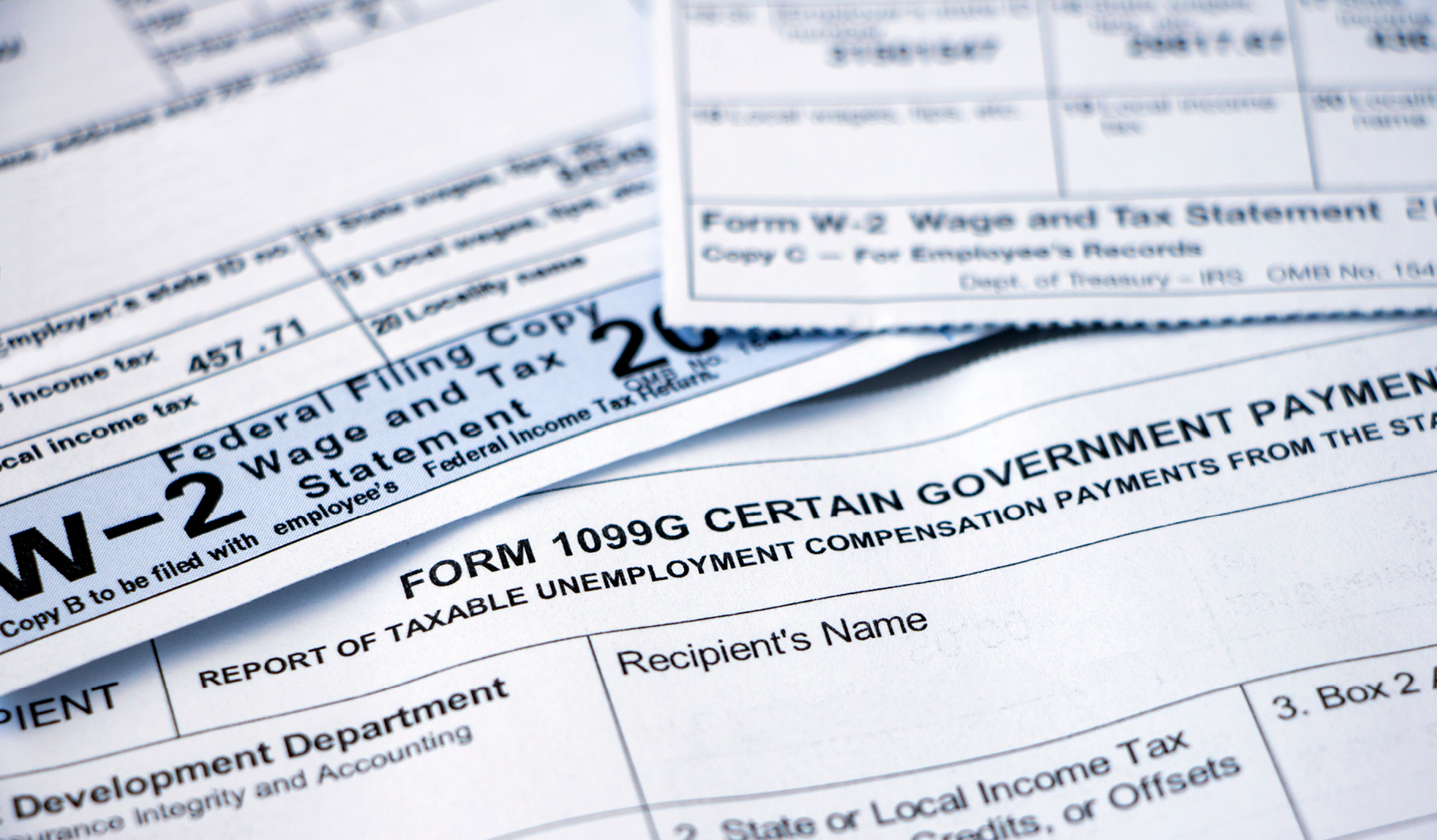

• Proof of income (wages, interest and dividend statements): Forms W-2, 1099, 1098, Any other documents showing additional income

• Forms 1095-A, B, or C, Affordable Healthcare Statement

• Information related to any credits you’re claiming

• Your banking information (the account number and the routing number for your bank, which you can find on a blank check)